Ask,

What is the investment enthusiasm direction of the capital market?

What are the industries that are going up against the trend in COVID-19?

2020-2021-2022 are milestone years for some large multi-state operators (MSOs) in the United States, and it heats up year by year. IR Global, a well-known British service company, described a series of M&A activities in the cannabis industry. Robert Hoban, an analyst, described that especially since 2022, the best way to describe the cannabis industry is "the mountain is on fire". All over the world, there is a hot start related to cannabis investment and M&A, and cannabis capital market transactions are in full swing.

Many stocks rose against the trend.

According to the data of New Frontier Data, under the turbulent market of COVID-19's pandemic, although the average stock price dropped by 30% in 2021 due to the lack of forward momentum of the Federation, many stocks in the cannabis industry rose. Compared with the first quarter of 21, the share prices of Acres Holding (ACRHF) and Goodness Growth Holding (GDNSF) rose by 161% and 153% respectively in 2022.

Strategic acquisitions transaction doubled.

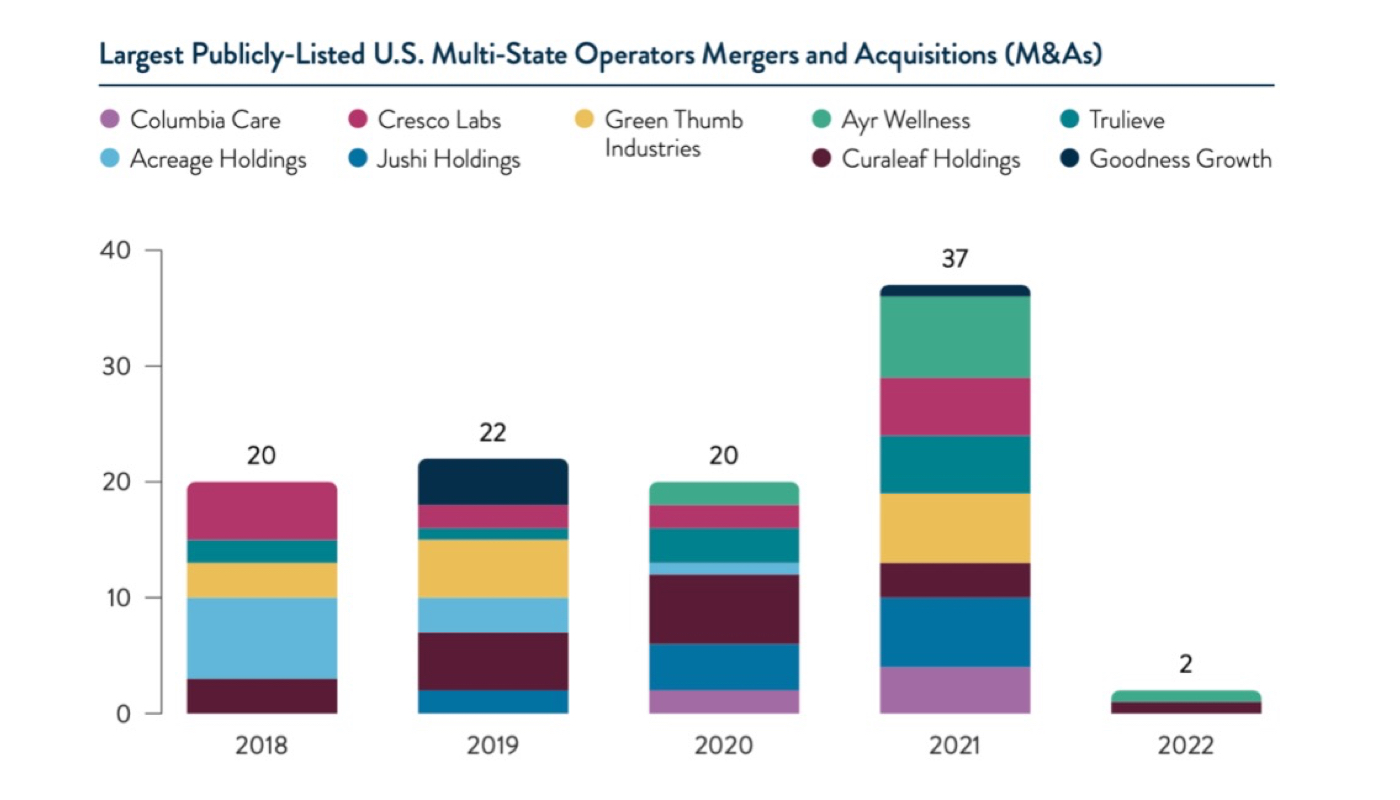

Meanwhile, MSOs, the major cannabis plant in the United States, still focuses on fund-raising and strategic acquisitions. From 2020 to 2021, M&A transactions in the largest listed M&A transactions almost doubled. Trulieve completed its $1 billion acquisition of Harvest Health & Recreation in October 2021, expanding its retail footprint to 11 states

It is worth noting that large pharmaceutical companies have entered the cannabis market. Jazz Pharmaceutical Company completed the acquisition of GW Pharmaceutical Company in May, 2011. GW pharmaceutical companies develop cannabinoid-based prescription drugs, including Epidolex. This cash-and-stock transaction totaled $7.6 billion. In December, 2011, Pfizer announced the acquisition of Arena Pharmaceutical Company for $6.7 billion.

The competition in the atomization market is also intensifying. Truelieve acquired Harvest Health & Recreation, expanding its retail network to 149 pharmacies in 11 states. Verano announced the acquisition of Goodness Growth Holdings. The deal will expand Verano's business scope to 18 states and allow it to obtain vertical integration licenses in Minnesota and New York.

Since 2022, investment mergers and acquisitions have become more popular. In particular, on March 23rd, Cresco Labs became the leader of cannabis market through the acquisition of Columbia Care. Cresco became the largest multi-state operator (MSO), with more than 130 stores in 18 markets in the United States in terms of estimated revenue ($ 14B-$1.4 billion). To predict more exciting 2022, the doctor will sort out the following list for you to see at a glance:

On January 1st, 2022, Green Thumb Industries acquired LeafLine Industries at an undisclosed price to enter the Minnesota medical cannabis market.

On January 3, 2022, Organigram's investment in the cannabinoid biosynthesis company Hyasynth increased by 2.5 million Canadian dollars to 10 million Canadian dollars.

On January 4, 2022, MJBiz was acquired by Emerald X for more than 120 million dollars.

On January 12th, 2022, SPAC partners of cannabis website Leafly raised $30 million before the merger.

On January 19th, 2022, Curaleaf Holdings completed the $211 million acquisition of Bloom Dispenses Aries, a vertically integrated cannabis company in Arizona.

On January 20, 2022, PharmaCann, a multi-state operator of cannabis, raised $39.5 million through the large-scale issuance of senior guarantee notes,

On January 26th, 2022, Icanic Brands acquired Leef Holdings, a cannabis extraction company in California, for $120 million.

On February 4, 2022, Creso Pharma said it would acquire Sierra Sage Herbs, a CBD manufacturer based in Colorado, in an all-stock transaction worth $21 million, thus enabling this Australian cannabis producer to enter the American market.

On February 7th, 2022, Leafly Holdings started trading in the public stock market with the stock code LFLY after completing the merger with Merida Merger Corp.I, a special purpose acquisition company. It is estimated that the combined entity value will be about $385 million and the equity value will be about $532 million.

On February 14th, 2022, Safe Harbor, a pioneering cannabis finance company, traded on NASDAQ through a $185 million transaction.

On February 15th, 2022, Jones Soda, a craft beverage manufacturer, acquired a Canadian shell company and raised $11 million as part of the development of hemp products.

On March 3, 2022, cannabis producer Tilray purchased and allied with US$ 211 million in debt to provide a lifeline for rival Hexo.

On March 24th, 2022, Incannex Healthcare of Australia bought APIRx Pharmaceutical BV, a Dutch medical cannabis company, for $93.3 million.

On March 8th, 2022, AFC Gamma provided nearly $50 million to three cannabis companies. Add $26 million to Chicago-based Verano Holdings, $15.3 million to Phoenix-based multi-state operator Nature's Medicines, and $5 million to Michigan-based Natrabis.

On March 10, 2022, British American Tobacco will invest another 6.35 million Canadian dollars (5.1 million US dollars) in Organigram, increasing its share in Canadian Atlantic cannabis producer Organigram to 19.5%. Last year, British American Tobacco (BAT) reached a strategic cooperation with Organigram through an investment of 220 million Canadian dollars.

On March 14th, 2022, Agrify, an auxiliary cannabis growing company, raised $135 million in additional funds.

On March 23, 2022, two major multi-state cannabis operators in the United States, Cresco Labs and Columbia Care, said on Wednesday that they had agreed to merge a blockbuster deal worth about $2 billion. Cresco, headquartered in Chicago, will acquire Columbia, headquartered in New York.

On March 24th, 2022, Aurora acquired TerraFarma for 38 million Canadian dollars to deepen the layout of high-end cannabis.

......

Transactions are quite different in many aspects, but it is not difficult to see that the development of cannabis industry and the corresponding M&A trend focus on effective adult and medical use, and constantly expand the global consumer base of cannabis, paying attention to the landing of real biomedical and Vaporized products.

Financing is more affordable

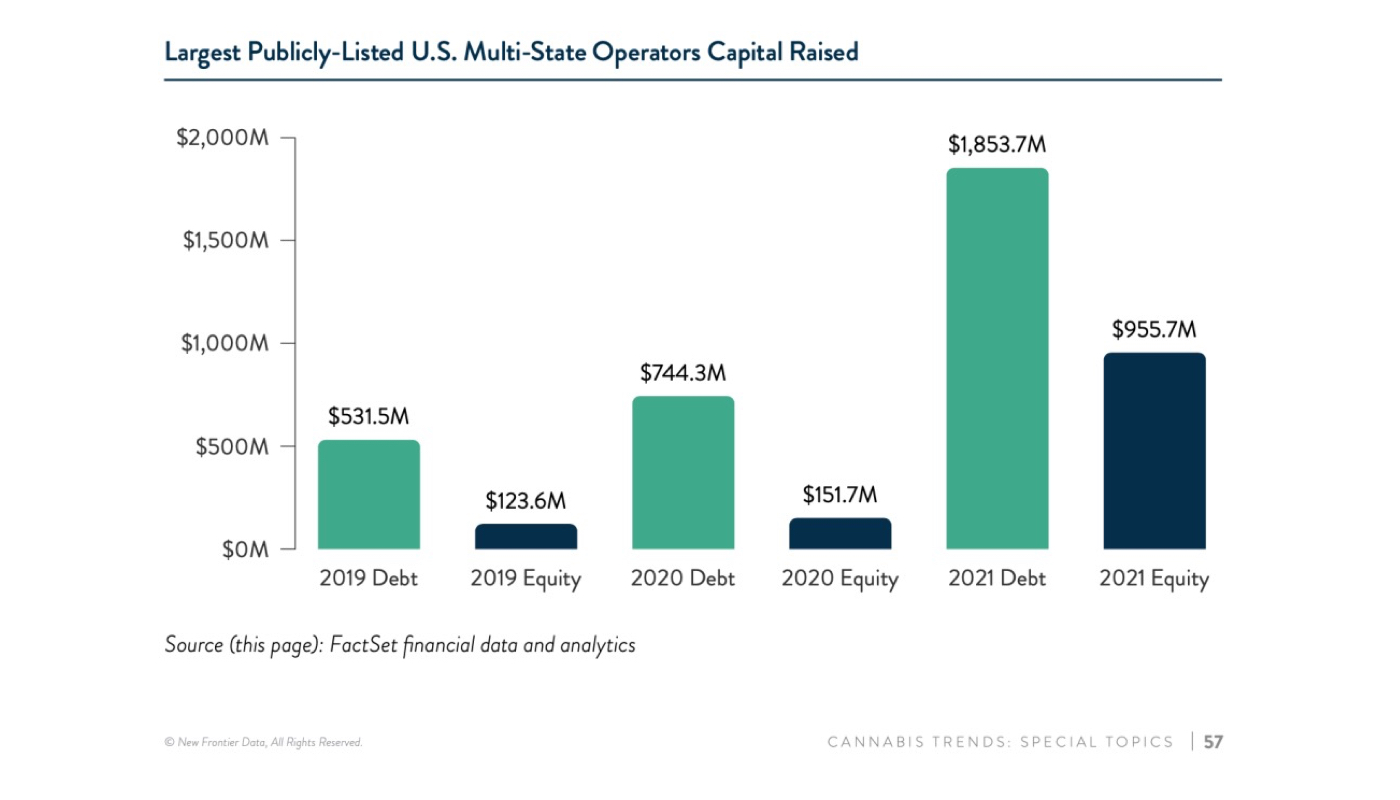

Although the pandemic initially caused people to hesitate to invest in cannabis industry, public service organizations achieved great success in 2021. According to the data collected by FactSet, nine major MSOs raised nearly $2.8 billion in 2021, compared with only $896 million in 2020. And obviously, the debt burden of these large operators has become more affordable. This year, Green Thumb Technology received $217 million in private equity financing at a price of 7%, compared with the IPO financing rate of 12% and $105 million in 2019. Similarly, Curaleaf also announced that it had privately raised $425 million 8% senior secured notes in December 2021. Compared with 2019, the company received a Senior secured Term Loan Facility of USD 275 million with an interest rate of 13%.

The expanding scale and scope of MSOs is likely to have a huge impact on the legal market in the United States. Although the federal wholesale tax, as outlined in the Capital Management and Opportunity Act, may offset the key cost-efficiency advantages of vertically integrating cannabis enterprises, the persistent inaction at the federal level will instead ensure that these companies will have the opportunity to continue to maintain their competitive position.

in conclusion

The increasingly fierce competition among American multi-state operators (MSOs) has promoted the development of investment and M&A activities. MSOs is keen on raising funds and conducting strategic acquisitions. During the COVID-19 pandemic, M&A activities of listed MSOs almost doubled. In addition, for MSOs with good reputation, the debt becomes more affordable, and the guaranteed coupon continues to decline among operators. The expanding scale and scope of these MSOs are likely to have a huge impact on the legal cannabis market in North America and even internationally. The latest news is that the U.S. House of Representatives passed the medical Cannabis research bill, and once again passed the landmark federal Cannabis legalization bill. The marijuana market is not only on fire, but also the fire will be even brighter ~

Let's wait and see! ! !

- [knowledge]The Latest Confirmation of Cannabis Medicinal Use (Science|HMI)

- [knowledge]Cannabis Capital Market is on Fire

- [knowledge]The Relationship Between Cannabis and COVID-19

- [knowledge]The Latest Historic Progress of Cannabis Industry in the United States

- [knowledge]The Legal Cannabis Industry is Working Wonders in the American Job Market.

- [knowledge]Six More States in the United States are About to Launch the "Green Gold Rush" of Cannabis in 2022.