Today's main topic is to get into business with Cannabis .

NEWS

[1] The legal cannabis industry will create about 428,059 jobs in 2022 and more than 280 new jobs every day.

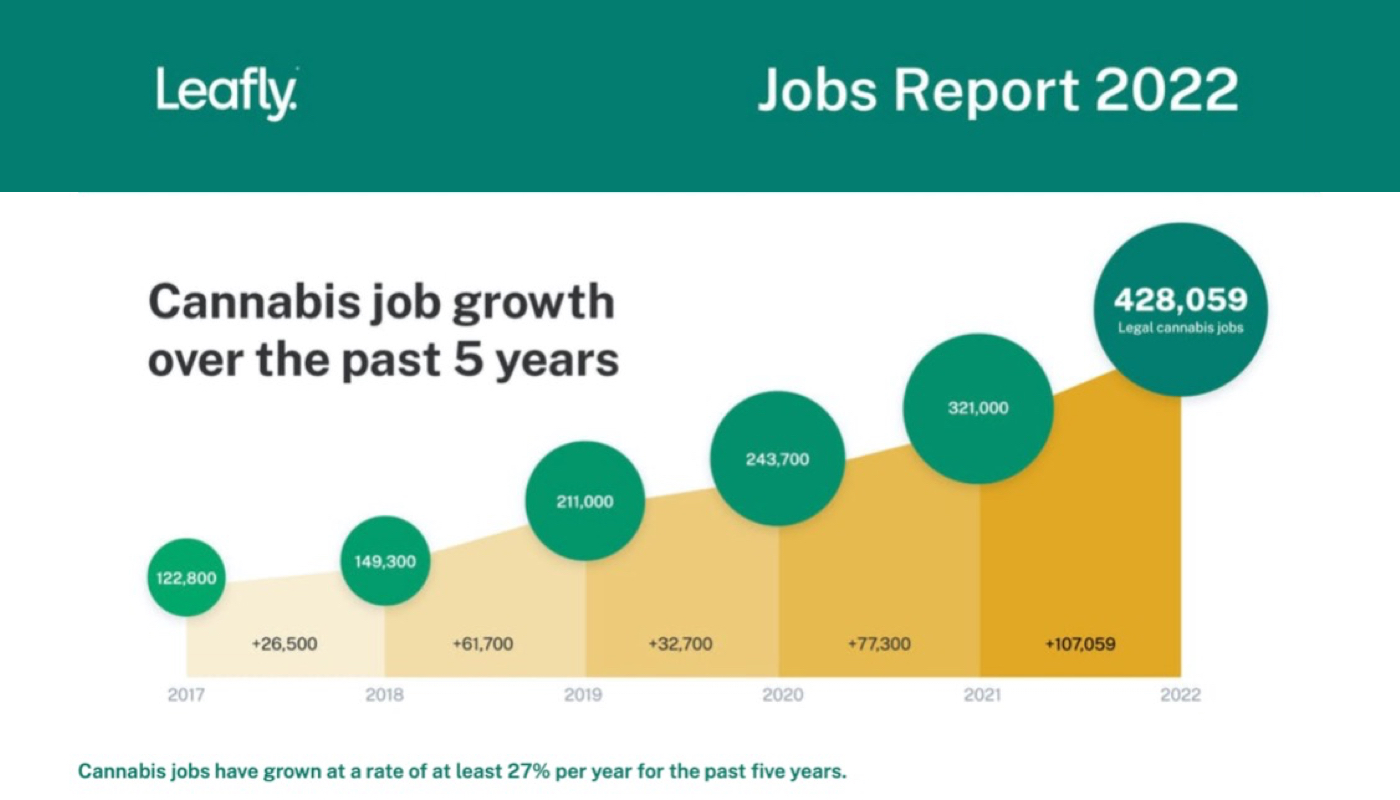

[2] In 2021, the number of jobs increased by 33%, which marked the fifth consecutive year that the annual employment growth rate exceeded 27%. No other industry in the United States can match it.

Research on American Cannabis Employment

Leafly Jobs Report Leafly & Whitney Economics

The annual Leafly Jobs Report, produced by Leafly in cooperation with Whitney Economics, is the most comprehensive study on cannabis employment in the United States. Together, the two parties released their 2022 annual employment report on February 23rd, discussing the latest situation of cannabis work, deeply studying the latest data of cannabis industry and forecasting the future. The legal cannabis industry is working wonders in the American job market!

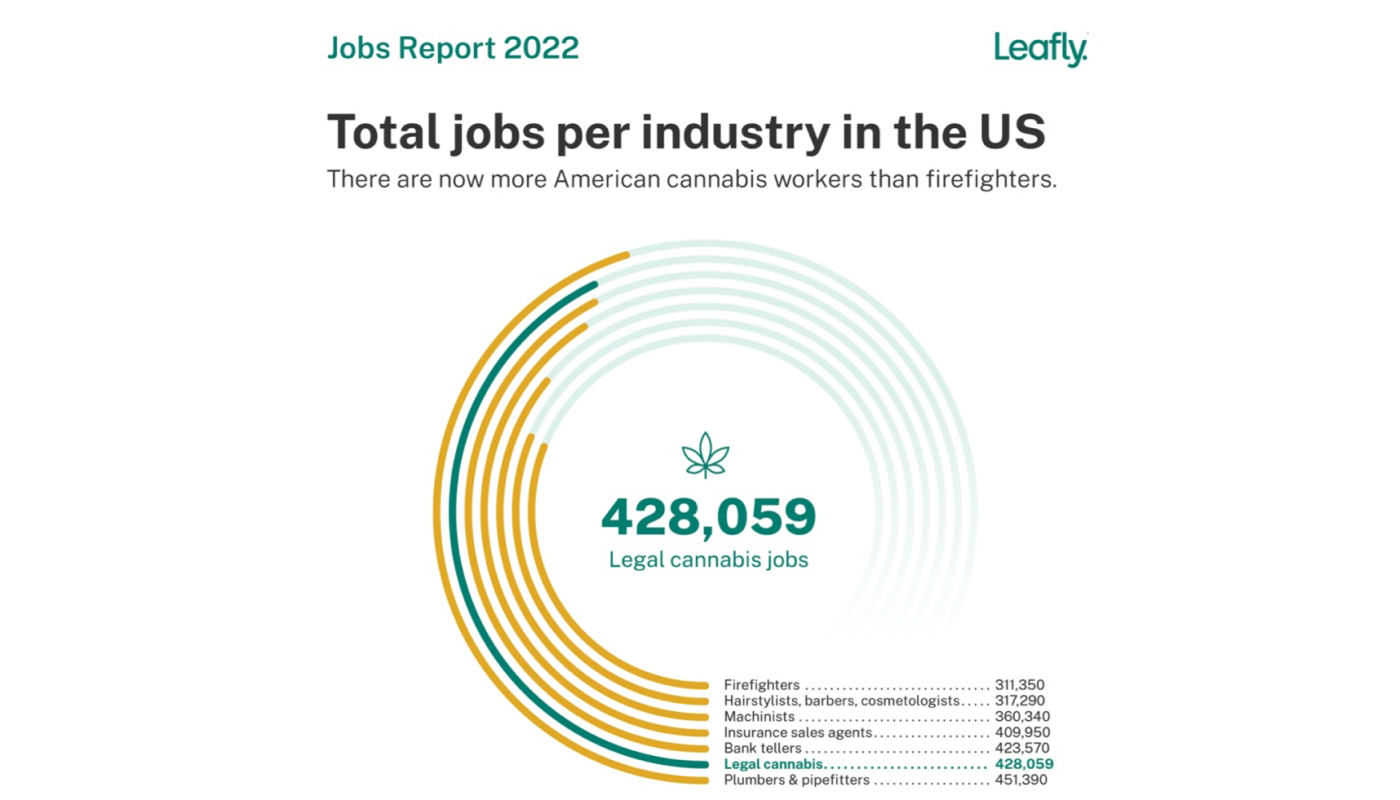

According to the annual report, in the past year, the legal cannabis industry (as of January 2022) supported about 428,059 jobs, covering various roles related to cannabis, from "plant-Related" jobs such as planting and retailing, to auxiliary jobs such as accounting, legal affairs, security or construction. Compared with previous years, the number of recent jobs has increased significantly: 321,000 jobs in 2021; Create 243,700 jobs in 2020; 211,000 people in 2019; 149,300 people in 2018; In 2017 (the first year of the employment report), there were 122,800 people. These 428,059 jobs in 2022 include direct cannabis jobs, such as planting and retailing–often referred to as "jobs involving plants"–and indirect auxiliary jobs for licensed companies or relying on legal cannabis sales. Auxiliary work includes accounting, human resources, legal affairs, regulatory compliance, security, maintenance and construction. It also includes indirect work in cannabis media, technology platform, public relations, lobbying, suppliers of non-cannabis products and industry associations.

HIGHTIMES also highlighted the following data from the report: "In the second year of the COVID-19 pandemic, the cannabis industry in the United States sold nearly $25 billion in products and created more than 107,000 new jobs—enough to fill the Rose Bowl (tip: the Rose Bowl is an annual American college football game, usually held in the Rose Bowl in Pasadena, California on New Year's Day)", and the number of jobs increased by 33%. No other industry in America can match it. Last year, the legal cannabis industry in the United States created more than 280 new jobs every day. In 2021, about every two minutes on a working day, one person was hired to do Cannabis-supported work. The report also provides other comparative ways to look at the problem, including that the number of cannabis workers in the United States is three times that of dentists, and the number of cannabis workers is more than that of hairdressers, hairdressers and beauticians combined.

Leafly Jobs Report also subdivides the major cannabis job market, and makes an in-depth study of the following states that are considered to be relatively leading indicators of the economic health of the cannabis industry, including California, Michigan, Illinois, Massachusetts, Florida (medical only), Arizona, Oregon, New Jersey, New York, etc.

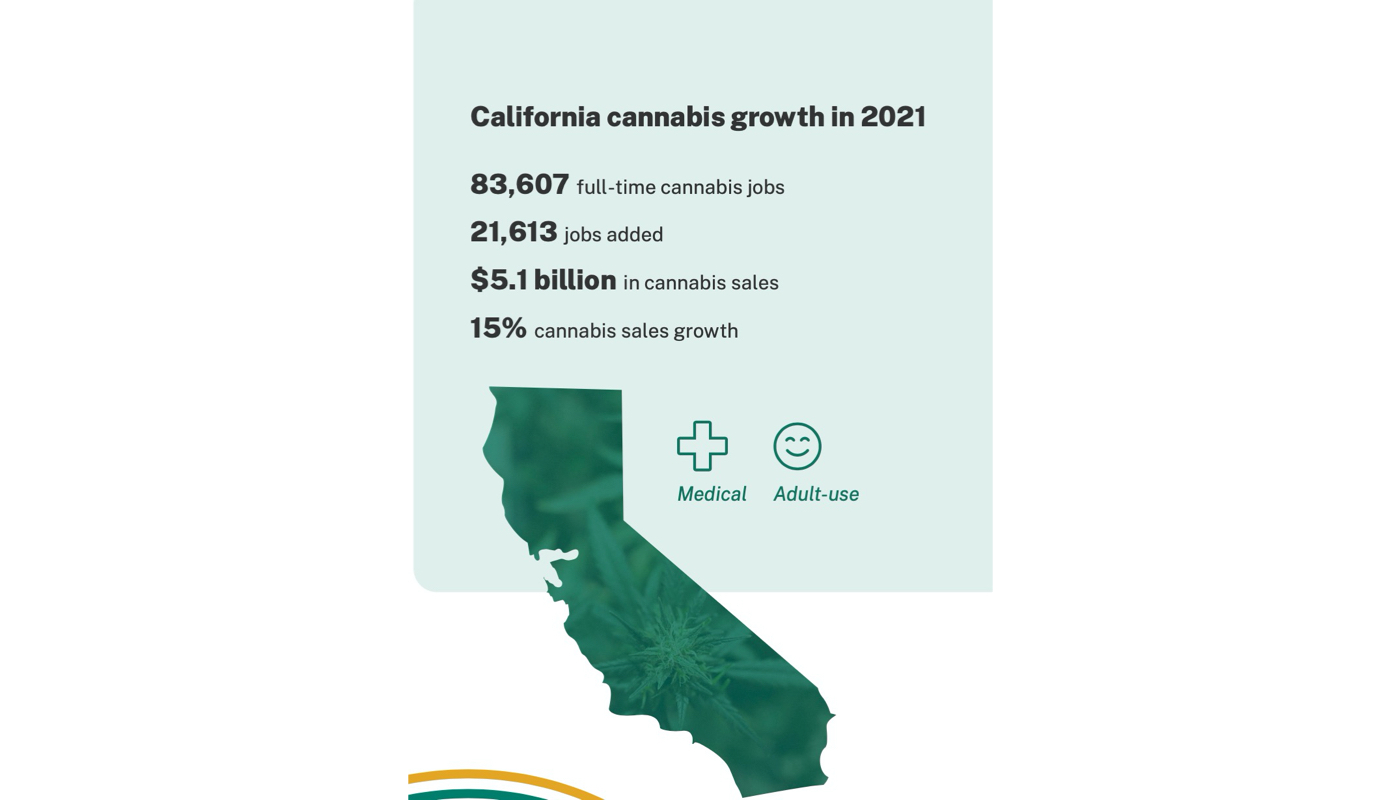

California

California remains the leading cannabis employer in the United States, with sales of $5.1 billion in 2021, supporting 83,607 jobs. After a 64% growth in 2020, the cannabis market in the state slowed down to a moderate growth of 15% in 2021. Employment growth is usually linked to income, but it is not completely consistent. Due to the tightening of investment capital and reluctance to commit to new recruitment under the uncertainty of coronavirus pandemic, the number of employees in 2020 will lag behind. Investment funds and recruitment confidence in California are hot again in early 2021. However, California's structural problems-high marijuana tax, red tape and local ban on marijuana shops-continue to hinder the prosperity of the industry. Five years after California voters passed Proposition 64, only 32% of local jurisdictions in the state allow regulated sales. These local bans support the illegal market, resulting in an oversupply of growers and a shortage of franchised stores.

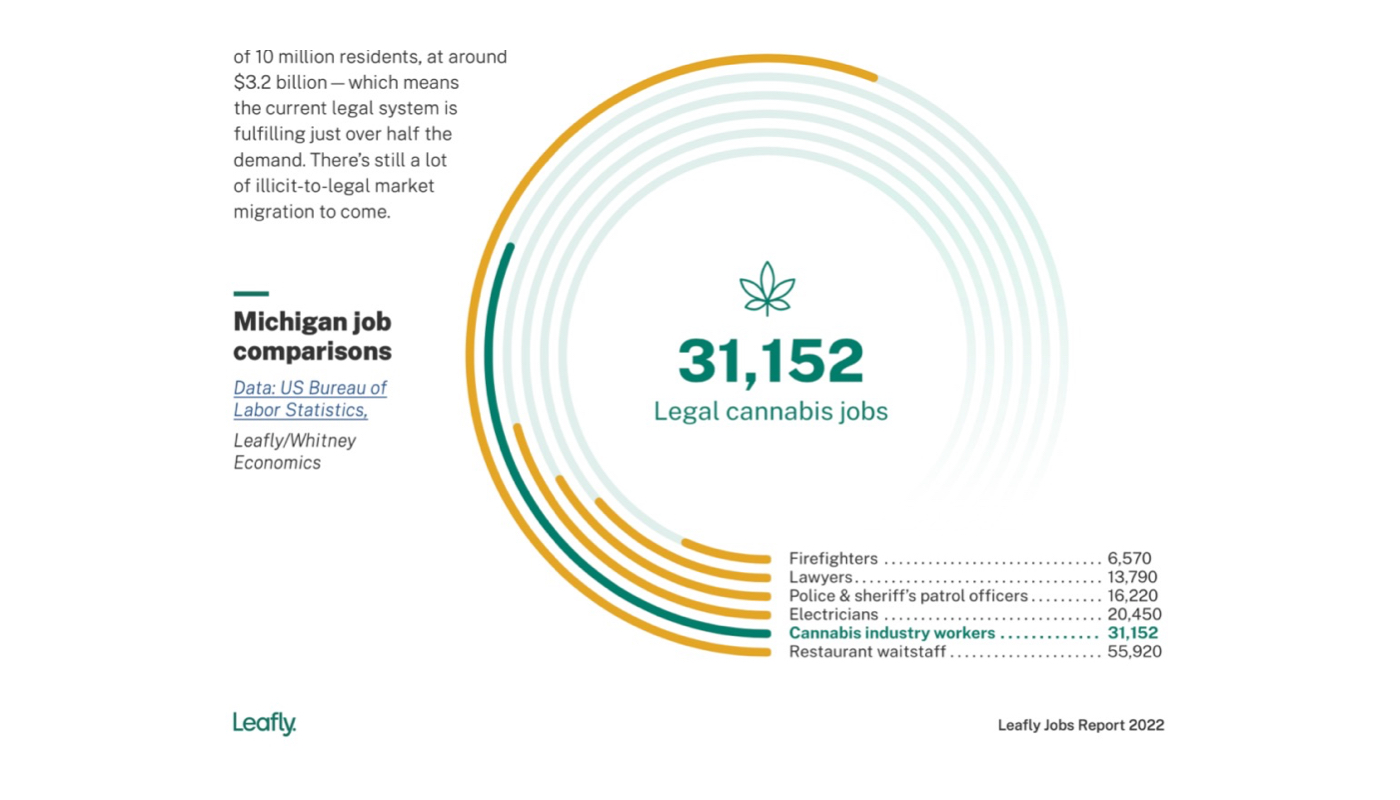

Michigan

Marijuana sales in Michigan soared by 81% to $1.79 billion in 2021, supporting 31,152 jobs. As far as statewide cannabis employment is concerned, Michigan's annual employment growth of 72% makes Michigan second only to California and Colorado. Michigan has a strong medical and adult use market, with 402 dual (adult use and medical) retailers, 47 adult use stores and 63 independent medical supply centers. Since there is no upper limit on the number of retail licenses, Michigan's regulatory system has made great progress in shifting the entire cannabis demand in the state to licensed and regulated markets. However, the local municipal government's ban on legal sales continues to support the illegal market. Of the 1,700 towns in Michigan, only about 160 allow adults to use and sell. Whitney Economics estimates that Michigan's total demand for marijuana with 10 million residents is about $3.2 billion-which means that the current legal system can only meet more than half of the demand. There are still a lot of illegal to legal market migration coming soon.

Illinois

Illinois' cannabis industry sold $1.78 billion in products in 2021, supporting 28,992 legal cannabis jobs. Compared with 2020, sales increased by 73%. Due to the sharp decline in the number of retail stores, Illinois' real income and job creation potential continue to lag behind. Illinois has 103 adult stores and 55 medical pharmacies. Currently, only 12 stores per million residents are licensed. Compared with states such as Oregon (181 stores per million residents), Massachusetts (54 stores per million people) or Michigan (51 stores per million people), the access problem in Illinois becomes obvious. The good news is that there are still 185 retail licenses-most of which are issued to social justice applicants-in preparation. The bad news is that they are dragged down by lawsuits, which have the potential to get them into trouble indefinitely, draw money from startups and leave thousands of new jobs to be created.

Massachusetts

Massachusetts continues to operate a robust and well-regulated cannabis industry with total sales of $1.65 billion in 2021, supporting 27,212 jobs. The revenue figure of $1.65 billion is 81% higher than the sales in 2020. Massachusetts continues to open more licensed retail stores online, with 387 retail licenses approved by the beginning of 2022, up from about 270 at the end of 2020. The moderate expansion of the state enables Massachusetts to continue to move consumers out of the illegal market, and increases the number of people employed in the legally regulated industries in the state.

Florida

Florida's medical marijuana boom will last until 2021, with sales of $1.5 billion, supporting 25,895 jobs. The increasing number of medical marijuana patients in the state has driven the growth in the past year, with 200,000 residents added to the list of registered patients in Florida. The number of medical marijuana patients in this state is 656,000, almost twice that of other large medical markets such as Pennsylvania and Oklahoma. Florida also continues to improve access, with 399 pharmacies licensed by the beginning of 2022. There has been an increase of 33% in the past 12 months, that is, nearly 100 new pharmacies. It is worth noting that the growing number of medical marijuana patients in Florida accounts for only 3% of the state's 21 million residents. Legalization and regulation of adult market can double the sales and employment in this state in one to two years.

Arizona

2021 is the first year of adult use sales in Arizona. There are 23,333 jobs supported by legal cannabis in the cannabis industry, with an increase of about 2,600 jobs. The increase in sales for adult use has increased the overall cannabis market in the state by 31% compared with 2020. Licensed adult cannabis stores and medical pharmacies in Arizona sold a total of $1.35 billion in cannabis products in 2021, which is $320 million higher than the data of selling cannabis products for medical use only in 2020. Why did sales increase by 31% while recruitment only increased by 13%? This is because Leafly and Whitney Economics included the recruitment boom used by most adults in the state into last year's cannabis employment calculation. In January, 2021, many companies have increased their wages in order to start selling recreational cannabis from that month. Referring to a similar situation in Florida, Arizona may generate a market of $4 billion a year, supporting more than 70,000 jobs.

Oregon

Oregon consumers bought $1.18 billion of cannabis products in 2021, an increase of 7% over the previous year. As of January 2022, the legal cannabis market in Oregon supports 19,938 jobs. As one of the most mature adult-use states in the country, Oregon's relatively slow and steady growth conforms to the pattern we have seen in Colorado, Washington and other early re-law adopters. After experiencing a huge increase in annual income in the first five years of adult sales, these markets are reaching a natural maturity with the majority of illegal market consumers completing their migration to the legal market.

New Jersey

New Jersey's restricted and poorly regulated medical marijuana system sold about $189 million in marijuana products last year, supporting 3,147 jobs. Patients in this state have long suffered from one of the most expensive and difficult to obtain medical marijuana programs in the United States. At the end of 2021 in New Jersey, there were 123,000 registered medical marijuana patients, which were only served by 23 operating pharmacies. In addition, the cannabis regulatory system in New Jersey is backward. No one in the state keeps track of the sales of medical marijuana, so no one knows how much it was sold, or to whom. The state levies taxes on medical marijuana—4% in the first half of 2021 and 2% in the second half of 2021—but according to Leafly research, officials of the New Jersey Department of Taxation can't tell how much revenue these taxes bring, that is, the state tax department doesn't know where the money from marijuana tax goes.

New York

In 2021, the sales volume of licensed pharmacies in new york in the medical market was USD 149 million, currently supporting 2,358 jobs. Only 40 licensed pharmacies serve 20 million people in new york, and New York remains one of the most restricted and underserved medical marijuana markets in the United States. This dysfunctional system pushes patients and jobs to the illegal market. In 2021, about 140,000 people in New York held medical marijuana cards. According to the national average patient expenditure of $2,700 per year, through reasonable prediction, this patient group will spend $378 million per year. This will support over 6,000 jobs. But this is not the case. On the contrary, tax data show that patients spend an average of $1,130 a year in licensed pharmacies in New York State, which is less than half of the national average. People in new york don't need less medical marijuana, they just get it outside the legal system.

Ps: Compare the data of 2021

Analysis and prediction

It is worth mentioning that the federal ban prevents the U.S. Department of Labor's Bureau of Labor Statistics from counting the legal marijuana work in the state. Leafly calculates the marijuana work because it is important and represents the future development trend. Since 2017, Leafly's news and data team has filled this gap by making an annual analysis of the employment situation in the legal cannabis industry. Whitney Economics is a global leader in cannabis business consulting, data and economic research, and has been working with Leafly on this project since 2019.

The author of the report estimates that these figures will only continue to rise in the next few years, but there are still many opportunities for growth. "In the eight years since the opening of the first adult marijuana store in America, the industry has created hundreds of thousands of new jobs in America. There are still many things to be created. Whitney Economics calculated that the total cannabis sales in 2021—just under $25 billion—accounted for only about 25% of the total potential cannabis market in the United States, "the report stated. It goes on to say that 75% of the demand of the cannabis industry is met through illegal cultivation and sales. It is estimated that the value of the cannabis industry may be as high as $45 billion by 2025.

Even in the case of historical unemployment during the pandemic, this data is still an important milestone in tracking the growth of cannabis industry. According to Morgan Fox, political director of NORML, the future looks promising. "While other economic sectors are in trouble and people are leaving their jobs, the legal cannabis industry is booming, employment is increasing exponentially, and it attracts talented and motivated individuals from the entire labor market," Fox said. "However, outdated federal laws define these people as criminals. Therefore, they are often denied access to banking services, housing, education, international travel and citizenship. It is high time for Congress to end the ban and start treating this powerful regulated market like any other industry. "

in conclusion

With the epidemic situation in the United States intensifying and the unemployment rate soaring, the cannabis industry has shown its long-term development potential. On the premise of steady growth in market sales, we can consider how the cannabis industry can provide more suitable jobs. The cannabis market in various states in the United States shows strong demand. With the promotion of the access of cannabis planting license, the policy blessing promotes the steady improvement of the cannabis industry in the long-term development. The multi-state medical Cannabis regulations and the legalization of recreational marijuana in the United States not only triggered a new wave of legalization of international laws, but also made the development path of the United States clearer.

America will be greener and greener in 2022. Cannabis has become a trend in the United States, and all walks of life are converging in the direction of cannabis. The existing market is growing, emerging markets are constantly emerging, and the cannabis industry has a huge space for development. Undoubtedly, the jobs that the cannabis industry can provide are bound to continue to increase day by day on the basis of the present situation. It is revealed that HMI Group is also looking for the most suitable partner to move forward together.

Are you excited about the future trend that such magical plants are so happy to lead? ? ?

- [knowledge]The Latest Confirmation of Cannabis Medicinal Use (Science|HMI)

- [knowledge]Cannabis Capital Market is on Fire

- [knowledge]The Relationship Between Cannabis and COVID-19

- [knowledge]The Latest Historic Progress of Cannabis Industry in the United States

- [knowledge]The Legal Cannabis Industry is Working Wonders in the American Job Market.

- [knowledge]Six More States in the United States are About to Launch the "Green Gold Rush" of Cannabis in 2022.